Expansion of the Bearings Market in Asia-Pacific: Drivers and Innovations

1. Asia-Pacific Bearings Market Overview

The APAC bearings market, valued at $38.2 billion in 2024, is projected to grow at 7.8% CAGR (2024-2030)—outpacing North America and Europe.

Market Breakdown by Country (2024)

| Country | Market Share | Key Growth Driver |

|---|---|---|

| China | 48% | EV production, industrial automation |

| Japan | 22% | Robotics, precision engineering |

| India | 15% | Automotive, wind energy |

| South Korea | 8% | Semiconductor equipment bearings |

| ASEAN | 7% | Cheap labor, export manufacturing |

2. Key Growth Drivers

🚀 1. Booming Electric Vehicle (EV) Production

China (world’s largest EV market) needs high-speed, low-friction bearings for motors.

India’s Tata Motors & BYD scaling up EV output → ↑30% bearing demand by 2026.

🏭 2. Manufacturing & Industrial Automation Surge

China’s "Industry 4.0" push → Smart bearings with IoT sensors.

Vietnam/Thailand becoming bearing export hubs (cheaper than China).

🌬️ 3. Renewable Energy Expansion

India’s 500 GW renewable target → Wind turbine bearing demand ↑18% YoY.

China’s dominance in solar trackers → Need for corrosion-resistant slewing bearings.

🛠️ 4. Government Support & Localization

"Make in India" policy → SKF, Schaeffler opening new plants.

China’s self-sufficiency push → Domestic brands (C&U, LYCT) replacing imports.

3. Innovations Shaping APAC’s Bearing Industry

🔧 1. Smart & Connected Bearings

Japan’s NSK developed AI-powered bearings predicting factory machine failures.

China’s Wanxiang investing in 5G-enabled bearing sensors for industrial IoT.

⚡ 2. High-Performance Materials

Hybrid ceramic bearings (Si3N4) for EVs (Japanese tech + Chinese production).

Graphene-coated bearings (South Korean R&D) reducing friction by 40%.

🌿 3. Green Manufacturing

India’s ABC Bearings using solar-powered factories.

China’s Haizhou Group recycling 90% of steel waste in production.

🤖 4. Additive Manufacturing (3D Printing)

Japan’s JTEKT testing 3D-printed titanium bearings for aerospace.

Singapore startups prototyping customized bearings for robotics.

4. Competitive Landscape

| Company | Country | Strategy |

|---|---|---|

| C&U Group | China | Price leadership, global expansion |

| NSK Ltd. | Japan | High-precision tech for robotics |

| ABC Bearings | India | Focus on wind & EV sectors |

| Wafangdian Bearing | China | Military/railway dominance |

Western Players’ Approach:

✔ SKF – Localizing production in India (new Chennai plant).

✔ Schaeffler – Partnering with BYD for EV-specific bearings.

5. Challenges

⚠️ 1. Overcapacity in China

Price wars among 2,000+ local manufacturers.

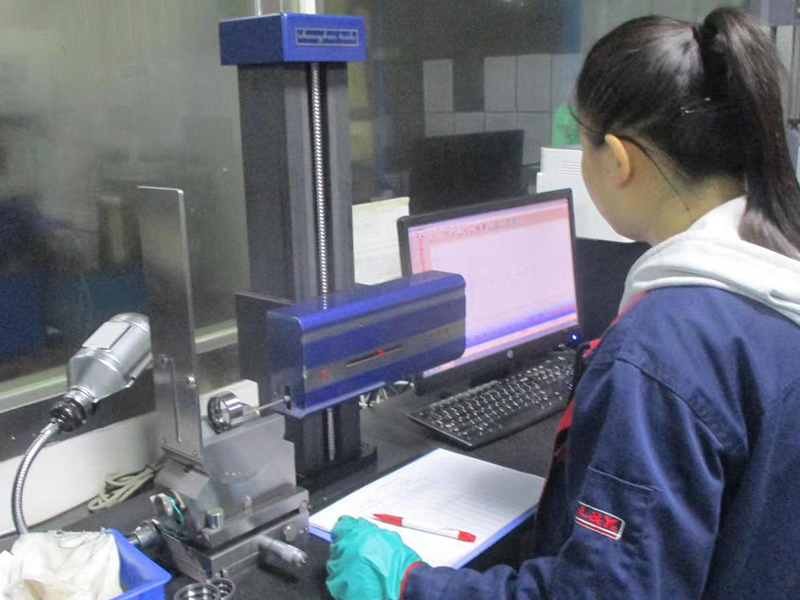

⚠️ 2. Quality Control Issues

India/ASEAN face counterfeit bearing problems.

⚠️ 3. Trade Wars & Tariffs

US/Europe blocking Chinese bearings over dumping concerns.

6. Future Outlook (2025-2030)

✔ China will remain production hub, but India/Vietnam grow faster.

✔ More regional R&D centers (Japan/S. Korea lead innovation).

✔ Bearings-as-a-Service models emerging (predictive maintenance).

7. Strategic Recommendations

✅ For Buyers: Audit Chinese suppliers for quality (ISO 9001/TS 16949).

✅ For Investors: Target Indian EV/wind energy bearing makers.

✅ For Startups: Develop AI-based bearing health monitoring.

8. Conclusion

APAC’s bearing market growth is unstoppable, driven by EVs, automation, and local policies. While China dominates, India & ASEAN offer cost advantages, and Japan/S. Korea lead tech innovation.