Global Bearing Industry Trends in 2025: Innovation, Sustainability, and Market Shifts

The global bearing market, valued at $120 billion in 2024, is undergoing rapid transformation driven by automation, electrification, and sustainability demands. With industries like electric vehicles (EVs), renewable energy, and robotics pushing for higher efficiency, manufacturers are innovating with smart bearings, advanced materials, and AI-driven predictive maintenance.

This 2,500-word industry report covers:

✅ Market growth projections (2025–2030)

✅ Key technological advancements (IoT, self-lubricating bearings)

✅ Sustainability regulations impacting supply chains

✅ Regional competitive shifts (China vs. Europe vs. North America)

✅ Top 10 bearing manufacturers and their 2025 strategies

1. Market Overview: Growth & Key Drivers

1.1 Current Market Size & Forecast

2025 Market Value: $130 billion (6% YoY growth)

2030 Projection: $170 billion (CAGR 5.8%)

Top Segments:

Automotive (35% share): EV bearings dominate.

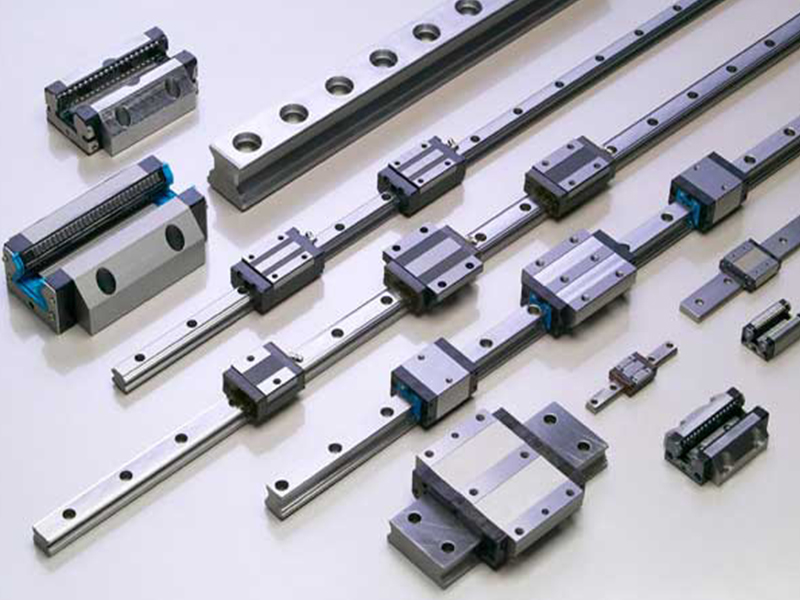

Industrial Machinery (28%): Robotics and automation surge.

Aerospace (12%): Lightweight ceramic bearings in demand.

1.2 Demand Drivers

EV Revolution: 20% increase in high-speed, low-friction bearings for motors.

Wind Energy Expansion: Offshore turbines require larger, corrosion-resistant bearings.

Factory Automation: Robotic arm bearings with 50,000+ hour lifespans critical.

2. Technological Innovations Shaping 2025

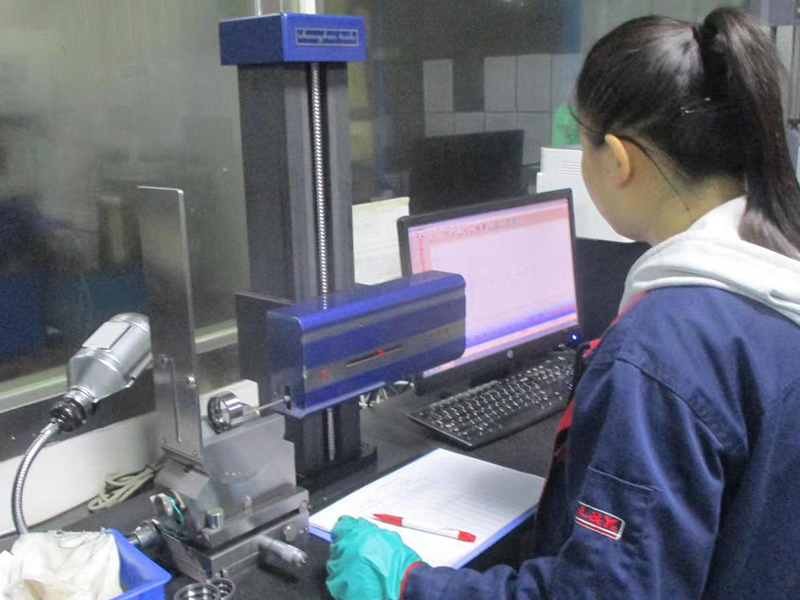

2.1 Smart Bearings & IoT Integration

SKF’s Enlight AI Bearings: Real-time vibration sensors cut downtime by 30%.

Schaeffler’s “Smart Cage”: Monitors load distribution via embedded RFID.

2.2 Material Breakthroughs

Hybrid Ceramic Bearings (Si3N4): 60% lighter than steel, used in Tesla’s next-gen EVs.

Self-Lubricating Polymers: Reduce maintenance in food processing and pharmaceuticals.

2.3 Additive Manufacturing (3D Printing)

NSK’s Laser-Sintered Bearings: Custom geometries for NASA’s lunar rovers.

Cost Reduction: 3D-printed prototypes cut R&D time by 40%.

3. Sustainability & Regulatory Pressures

3.1 Carbon-Neutral Manufacturing

EU Carbon Border Tax (2026): Bearings imported to Europe face 5–10% tariffs unless emissions-certified.

Timken’s Green Steel Initiative: Partners with SSAB for fossil-free steel bearings.

3.2 Recycling & Circular Economy

NTN’s Remanufacturing Program: Refurbished bearings save 50% CO2 vs. new production.

End-of-Life Solutions: Schaeffler’s chemical recycling extracts chromium for reuse.

4. Regional Competitive Landscape

4.1 China’s Dominance & Challenges

Export Growth: Chinese brands (LYC, C&U) now supply 30% of global aftermarket bearings.

Trade Barriers: Anti-dumping duties in India (8–15%) and U.S. (7.2%).

4.2 Europe’s High-End Focus

Germany’s “Industry 4.0 Bearings”: FAG (Schaeffler Group) leads in AI-integrated solutions.

Sweden’s SKF: Invests $200M in wind turbine bearing gigafactories.

4.3 North America’s Reshoring Push

U.S. Defense Contracts: RBC Bearings wins $300M deal for military drone bearings.

Mexico’s Manufacturing Hub: Koyo builds $50M plant near Texas border.

5. Top 10 Bearing Manufacturers (2025 Rankings)

| Rank | Company | Key Strength | 2025 Strategy |

|---|---|---|---|

| 1 | SKF (Sweden) | IoT-enabled bearings | Expand wind energy solutions |

| 2 | Schaeffler (Germany) | EV motor bearings | Double U.S. production capacity |

| 3 | NSK (Japan) | Robotics precision bearings | 3D-printed custom bearings |

| 4 | Timken (U.S.) | Aerospace & defense focus | Sustainable steel partnerships |

| 5 | NTN (Japan) | Cost-effective automotive bearings | Grow India/Mexico plants |

| 6 | JTEKT (Japan) | Steering system bearings | AI-driven predictive maintenance |

| 7 | LYC (China) | High-volume industrial bearings | Comply with EU carbon rules |

| 8 | RBC Bearings (U.S.) | Military/space bearings | Acquire additive manufacturing startups |

| 9 | C&U (China) | Aftermarket dominance | Invest in ceramic bearings |

| 10 | Nachi (Japan) | Hybrid ceramic-steel bearings | Robot bearing automation |

6. Future Outlook (2025–2030)

AI & Digital Twins: 80% of industrial bearings to have cloud-connected diagnostics by 2030.

Localized Production: Tariffs push 50% of Western brands to build plants in India, Mexico, and Eastern Europe.

Space Applications: Molybdenum-disulfide lubricated bearings for Mars rovers (NASA/SpaceX contracts).

Conclusion: Strategic Takeaways

For Buyers: Prioritize IoT-compatible, low-carbon footprint bearings to future-proof supply chains.

For Suppliers: Invest in 3D printing and recycled materials to meet 2026 EU regulations.

For Investors: Watch EV, wind energy, and robotics segments for high-growth opportunities.