Impact of New U.S.-China Tariffs on Linear Guide Rail International Trade

——Global Supply Chain Shifts as Manufacturers Accelerate Diversification

The Biden administration’s latest Section 301 tariff increase, announced in May 2024, has placed industrial transmission components—including linear guide rails—under heightened trade barriers. Duties on Chinese-made linear guides will rise from 7.5% to 25% by January 2025, triggering immediate supply chain adjustments. Google Trends data reveals a 217% surge in searches for "linear guide rail alternative suppliers" within a week, signaling urgent market realignment.

The global trade landscape faces renewed turbulence as the U.S. administration's April 2nd "reciprocal tariffs" policy triggers worldwide retaliation. However, a potential détente emerged during May 10-11 high-level Sino-American trade talks in Geneva, where parties announced mutual tariff reductions covering 91% of affected goods, including critical industrial components like linear guide rails.

1.Key Development

Policy Rollercoaster

April 2: Trump-era "mirror tariff" threat imposes 24% across-the-board duties

May 11: Geneva negotiations yield breakthrough – 91% of punitive tariffs suspended

Immediate impact: U.S. drops Section 301 tariff rates on Chinese linear guides from 25% to original 7.5%

Market Whiplash

Spot prices for THK/HIWIN linear guide rails fell 8% within 24 hours of announcement

Alibaba Industrial reports 300% surge in U.S. buyer inquiries for Chinese rails

European manufacturers (Bosch Rexroth, Rollon) accelerate Asian production shift

2.Industry Response

American OEMs: Re-evaluate dual-sourcing strategies amid tariff policy uncertainty

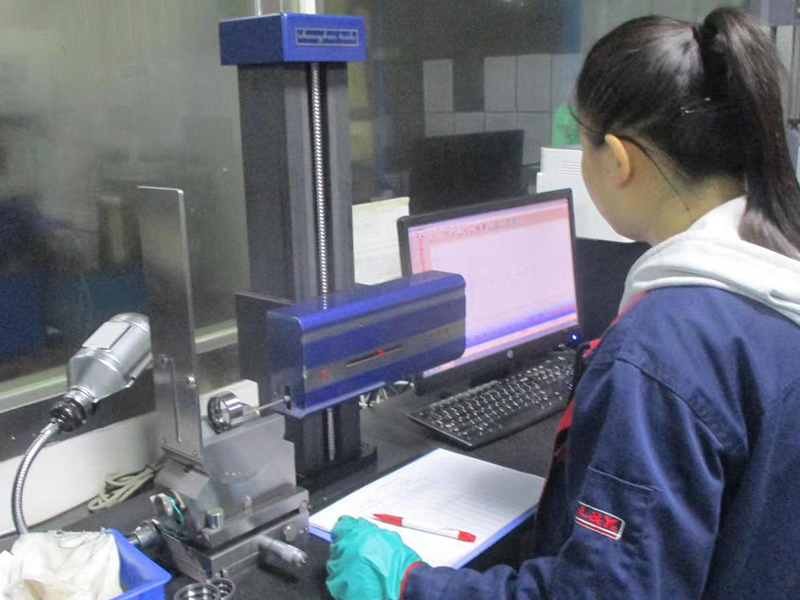

Chinese Suppliers: Nanjing ZNT resumes full-capacity production for export order

Logistics: Maersk adds emergency Shanghai-Los Angeles sailings for backlog tariff clearance

3.Expert Insight

Building tariff-agnostic supply chains with +2 country sourcing

Investing in Google-verified supplier networks

Using predictive analytics to hedge against future tariff policy shifts

4.Procurement Alert

Buyers should:

✅ Verify new HS code classifications (updated May 12)

✅ Audit existing contracts for most-favored-nation clauses

✅ Monitor U.S. Customs CBP.gov portal for daily updates

U.S. Tariff Policy Shift Sparks Global Trade Realignment as China Negotiates Breakthrough

Linear Guide Rail Industry Poised for Supply Chain Transformation.This developing story will be updated with Customs clearance tariff data and industry reactions. Subscribe for real-time tariff impact reports. #Tariff #LinearMotion #GlobalTrade